Most of us, myself included, have had to navigate the confusing world of financial aid. The Free Application for Federal Student Aid, or FAFSA, is the application used by ALL colleges and universities to assess how much money students can earn each year to help pay for college in the form of need-based financial aid. The website for the FAFSA has all the info one needs to claim money for college as well as federal deadlines so you know when to get your application submitted.

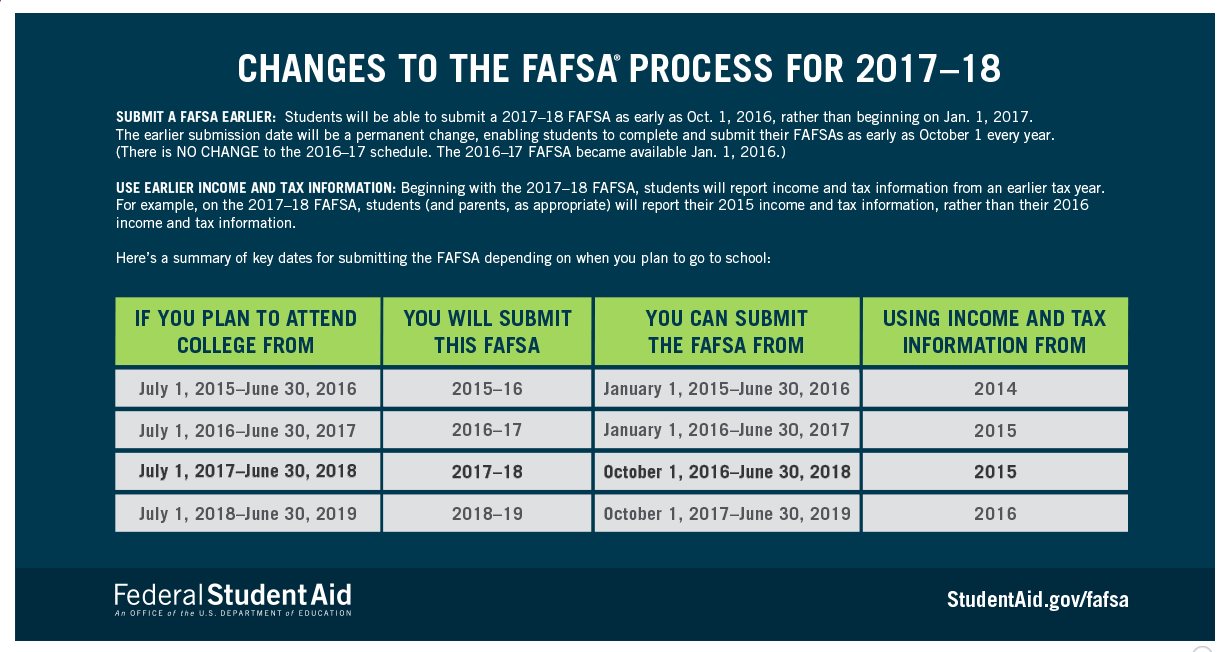

For years, the new FAFSA application for the following year opened on January 1st. However, there has been a huge change in the process this year – the FAFSA for the 2017-18 school year opened on October 1st, 2016.

The chart below shows us a breakdown of comparable dates and deadlines of FAFSA cycles.

What’s the difference here? You can now use your tax records from 2015, the previous fiscal year, which should already be prepared. This matters because in previous years you would have had to estimate your tax records and that could have affected how much money you received. If you estimated that your income was higher than it actually was, the FAFSA may have told schools that your family could contribute more financially than they actually could. Now, you will have all the numbers already prepared and be more certain of your financial situation; or simply put, no estimating required!

How can you claim your free college money?

There are so many different ways to get “free money” for college. Along with FAFSA, there are ways to cover the cost of college if need-based financial aid won’t cover you, such as scholarships and merit based financial aid. There are hundreds of articles for tips and tricks on getting the most money, but here are five that I have found the most useful as a current college student:

1. Ask questions. It is critical to fill out the FAFSA correctly, so ask campus financial aid offices, parents, or friends who have filled it out already when confusion arises.

2. File early. Make sure to get your application in by the PRIORITY deadline because that will give you the best chance at the most money. Also, deadlines for schools and states differ, so get it in early and make it one less thing to worry about!

3. Look into other scholarships. There are no guarantees to how much money the government is going to give you so make sure to look into and apply for scholarships as well. There are thousands of scholarships out there for everything from ethnicity to major to being left-handed. There are also databases that have search engines for scholarships, like College Board, that will compile your information and give you lists of scholarships you qualify for. Every dollar helps.

4. Don’t be afraid of loans. If you have to take out loans, which a lot of us do, don’t be afraid to. The federal government can help subsidize loans for students as well as parents. So plan ahead. Do your research and find those loans with low interest rates that will help you on your way to a college degree. Our SUNY Smart Track is a great resource to help guide you through these decisions.

5. Know what you will be expected to pay back and when. Most loans become due six months after graduation if you don’t continue on to a master’s degree or any further schooling. When you are taking out these loans, make sure you know what will become due when you graduate so as you approach your senior year you know what to plan for.

With these tips and the new early application for FAFSA, your path to college is open earlier than it has been before. SUNY takes financial literacy and financial aid quite seriously, which is why SUNY Smart Track is available to help all students and families understand college costs and develop a financial plan for the future. We also have SUNY Financial Aid Days happening twice a year, including this October and November, which are designed to answer questions and provide assistance regarding the financial aid application, types of aid available, and the award process. All are invited to attend.

SUNY is a great way to get an impeccable education at one of the lowest tuition rates around, but remember to claim that “free money” so cost doesn’t define your entire college decision.

Our friends at SUNY Cobleskill have put together this video that offers some tips on how to apply for financial aid at SUNY:

And the department of Federal Student Aid has this video that gives an overview of the whole financial aid process: