Student loans are a huge source of worry for many students across the United States. There are many reports of the rise in the student debt crisis in America which indicate the many challenges facing graduates looking to get ahead and into the middle class. But thankfully students at SUNY might have a bit of an advantage, because we’ve always known we were the smartest financial choice. With great schools at low costs, we’re the best value higher education option around. And SUNY students have themselves a financial edge in more than just low tuition.

The U.S. Department of Education recently reported reduced loan default rates among SUNY students. This means our students pay back their loans faster and more efficiently than other college students. This success can be largely attributed to the SUNY Smart Track program, which helps student borrowers take out the worry and make informed financial decisions. By teaching students how to understand college costs and preparing them for their financial futures, Smart Track helps to support degree completion and positions students to successfully repay their loans.

SUNY Smart Track is the most proactive, comprehensive approach by any university system in the U.S. to address national concern about the lack of transparency as it relates to college costs and financial aid, and the amount of loan debt accumulated by today’s college students. The program encompasses default prevention activities across SUNY and includes:

SUNY Smart Track is the most proactive, comprehensive approach by any university system in the U.S. to address national concern about the lack of transparency as it relates to college costs and financial aid, and the amount of loan debt accumulated by today’s college students. The program encompasses default prevention activities across SUNY and includes:

- A Standard Award Letter used by all campuses that clearly identifies all financial aid options available to the student;

- Financial Literacy resources and tools available on all SUNY campus websites, promoting financial wellness for prospective and current students as well as their families;

- Student engagement activities such as monitoring the academic success of “at-risk” student borrowers to ensure they remain on track to degree completion; and

- SUNY-wide Default Prevention and Financial Literacy Task Forces, which monitor the success of the program and look for continuous improvement.

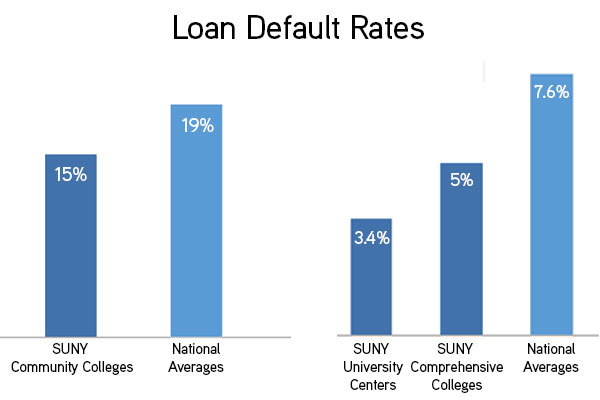

According to the 2012 federal cohort default rates released by the U. S. Department of Education, SUNY has seen significant reductions over the rates published last year. By sector:

- All four university centers showed reduced loan default rates, with an average of 3.4 percent, well below the national average of 7.6 percent;

- The average default rates at SUNY’s comprehensive college was 5 percent, also below the 7.6 percent national average;

- 23 SUNY community colleges showed reduced rates. SUNY community colleges show an average default rate of 15 percent, while the national average is 19 percent.

This data is further proof that in providing financial tools that complement the affordability of a SUNY education, SUNY has found precisely the right combination of cost transparency and financial planning to ensure completion and success for students while putting them in a position to graduate without an unmanageable loan debt. Smart Track helps students land in a less stressful financial future. Students should take every opportunity they can to take advantage of options like this to give them another step forward to a successful post-graduate life.

SUNY Smart Track program is a very helpful project from which student can easily understand college costs and can prepare themselves financially. wish u all the best for the future to extend the project in all over the world.

Hello Kay, SUNY Smart Track is a great project and in my opinion it must be extended in the whole world if it is possible!!! Well done and wonderful article Kay! 🙂

Best wishes,

Susan